Intil Will Overtake Amd Again Intel Will Overtake Amd Again

Andrei Berezovskii/iStock Editorial via Getty Images

Investment Thesis

I recently detailed AMD's (NASDAQ:AMD) data center announcements through 2023. I noted that given AMD's sluggishness to move to TSMC's (TSM) 5nm, AMD was giving Intel (NASDAQ:INTC ) an opportunity to catch up, and maybe overtake AMD even earlier than incoming CEO Pat Gelsinger promised investors upon his return to Intel (2024-2025).

However, upon second thought, I take reconsidered my opinion. Although Intel (as per my original assay) indeed seems to be moving quicker than AMD, that means that going forward Intel will just be (much) less backside… but without testify notwithstanding that Intel will actually reclaim operation leadership.

More than specifically, in the 2nd role of the original article, I considered some Intel rumors (to brand the case Intel could not just catch up, but also overtake AMD), without also considering further AMD rumors. Nevertheless, by also considering the AMD rumors, here I will revisit the previous analysis (which others have too washed already).

In conclusion, AMD's roadmap likely was stronger than I had anticipated in the previous article. So although I remain bullish on Pat Gelsinger (although I take consistently warned investors that this could take years to yield results), I have somewhat adapted my timing expectations for the results to become visible (in the data center).

Source: Twitter

Background

Although frequent readers of Seeking Blastoff may non assume this, in the past I have actually been quite critical of Intel'due south information center execution. For instance, I discussed this at length in Ice Lake-SP Tells A Cautionary Tale For Intel Investors.

Ane example I have used numerous times is that Intel delayed its Granite Rapids Xeon from Q1'22 past at least one year in the wake of the 7nm delay, despite that Intel said 7nm had been delayed past just 6 months. (For comparison, Intel'due south other 7nm CPU, Shooting star Lake for PCs, seems to have been delayed by only 3-vi months.) It is non clear why Intel would delay its data center CPUs much more.

If Granite Rapids had launched on schedule in Q1'22, then it would have been a articulate leadership product, since Milan-X would have had vastly lower core count, a larger process node, and an inferior overall feature set (lacking PCIe five.0, CXL, DDR5, etc.). And so, afterwards in 2022, AMD but would have been able to reduce its loss of leadership (not repossess leadership) with Genoa. This, indeed, confirms Pat Gelsinger'due south statement that Intel's manufacturing is a ascension tide that lifts all boats when it delivers, just conversely likewise drowns all boats when it doesn't.

Yet, this 12-month filibuster also means Intel's subpar execution in the data eye can't be fully explained past the process engineering delays alone. For a company that said (in 2017) it would become "data center-offset", this execution indeed should exist somewhat worrisome for Intel investors. Indeed, going back to at least 2013 (and up to November 2021), Intel has consistently touted the information center as its big growth driver, merely I have consistently identified this segment to be its weakest in terms of product execution.

More philosophically speaking, all the same, an annotator/investor can't just await at Intel'due south past and extrapolate, only has to guess each company's roadmap. From that view, Intel remains stuck between its poor 10nm execution and a supposedly improved roadmap going frontwards. So equally one of the bullet points said: let Intel outset deliver a strong CPU on schedule once again.

Turin: AMD'southward 256-cadre monster CPU

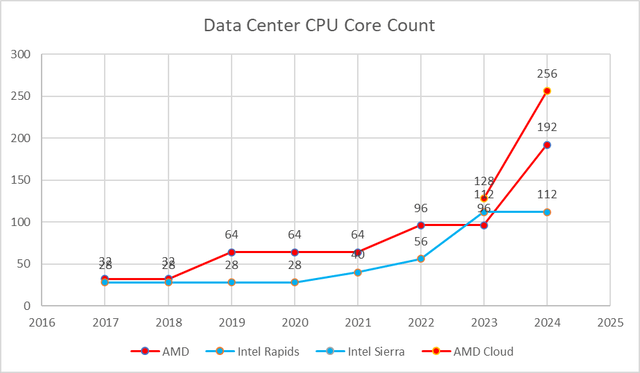

The thesis of my previous coverage was that investors should regard the new Zen 4c cadre in the 128-core Bergamo every bit a competitor to Intel's Sierra Forest CPU, which is rumored to incorporate at least 128 cores too (and potentially well over 200 cores). The Sierra Forest CPU would have a socket with over 7K pins, which I pointed out was an indication that Intel had big plans for this line of CPUs.

Yet, since Intel has not officially announced this CPU, some readers pointed out I was using mere rumors to base of operations my decision on (although the rumors came from independent sources). Then if I was going this route, and then I realized I should also have considered the AMD rumors.

This leads us to Turin. Not the Italian city, simply the Zen 5-based data center CPU from AMD that will succeed Genoa and Bergamo. The championship says everything ane needs to know about this CPU:

AMD EPYC Turin Zen five CPUs Rumored To Feature Upwards To 256 Cores & 192 Core Configurations, Max 600W Configurable TDPs

Based on the information AMD provided at the contempo outcome, we can now infer why there are two configurations for the core count: the regular Zen 5 will accept 192 cores (2x Zen iv), and the Zen 5c core will have 256 cores (2x Zen 4c). What is noteworthy about this is that AMD will apparently manage to double the core count (2x), despite that TSMC is only expecting a 1.6x shrink from 3nm. (Obviously, this is possible given that AMD'south CPU consists of relatively minor chiplets, which accept room to become larger: this likewise explains the rise in TDP.)

If i steps back, just a few years ago, AMD took the data center by storm by announcing a 64-core CPU when the current maximum from Intel was 28 cores. Looking forward, in 2024, AMD will launch 192-core and 256-core CPUs, and so conspicuously this continues a steady increase in core count roughly in line with Moore's Law. From that view, I was previously too surly about AMD's data middle roadmap.

To be certain, some AMD fans have proposed that AMD would launch Zen v in 2023, but this seems exceedingly unlikely given the Genoa and Bergamo launches in late 2022 and early on 2023: if it takes AMD over three years to movement from 7nm to 5nm, why would AMD all of a sudden be able to move to 3nm in just one year or less? Some recent (unconfirmed/contested) rumors indicate that AMD may utilize Samsung'south 3nm, simply that wouldn't change much.

In determination, to AMD'southward credit, AMD has executed very well in the data center, in contrast to Intel. This is best illustrated equally follows: AMD has made sure to ever launch its information middle CPUs within at nigh a few months of launching its desktop CPUs (in stark contrast to Intel'due south 6-18 months). Nonetheless, Zen v should firmly be regarded as a 2024 product, which does mean it should exist compared to Intel'southward 2024 roadmap.

Intel roadmap

Equally noted above, Intel announced in 2022 that it would get a "information middle-first" company. Indeed, ane can discover quotes from Intel executives where they promised to launch the 10nm++ and 7nm Xeons "commencement" (before any PC CPUs).

Instead, Alder Lake has already launched (ahead of Sapphire Rapids), and the 7nm delay acquired Granite Rapids to exist put backside Meteor Lake. Hence, to date the pattern still remains that Xeon tends to launch many quarters afterwards the PC Core CPUs, despite that the data center is now a ~$1B per quarter business for AMD (growing at triple digits) and despite the data eye explicitly being Intel'southward biggest growth engine.

This leads to the core thesis of this article: if Intel's execution in the data center remains subpar, and so Intel is at chance of losing more marketplace share to offset any general market growth. And if the data center isn't growing, which other segment is going to move the needle for Intel'due south growth? None.

With that said, investors should note that Intel went through a CEO transition in early 2021, and in mid-2021 the EVP of the data center (from 2017-2021), Navin Shenoy, was removed from Intel in a reorganization of the data center. From the discussion in this commodity, it is articulate that a reorg was indeed required.

In any case, I volition revisit my summary graph from previous article to brand information technology more rigorous. I take modified two things. Get-go, I removed Sierra Woods since the rumors are not unambiguous about its core count. Investors should simply keep in mind that Intel seems to exist working on its own ultra-high core count CPU, only will need to see more than proof beginning before investors should jump on any bandwagons. Secondly, I extended the projection to 2024, now incorporating the Zen v rumors. Conspicuously, Intel Rapids of a sudden doesn't seem to be so rapid anymore.

Source: Own Work

Has Intel lost?

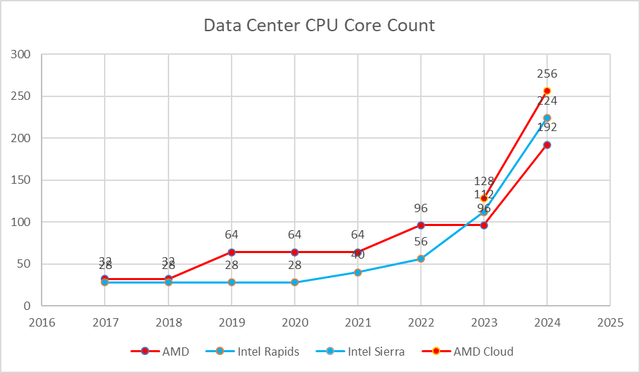

Of course, the in a higher place graph needs to revised farther (with less official information), since it is known that Intel plans to launch a successor to the 112-core Granite Rapids in 2024; I already indicated Turin should exist compared against Intel's 2024 roadmap. Intel's 2024 CPU is known as Diamond Rapids.

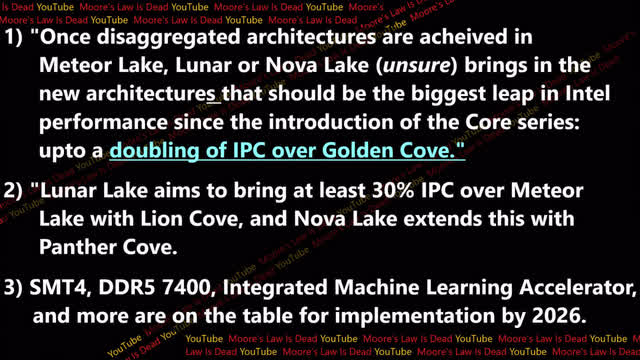

Source: Moore's Law Is Dead (YouTube)

Although nothing is currently known well-nigh Diamond Rapids, the rumor mill has already run wild about what kind of operation increases it could bring. I have included i such rumor higher up merely as analogy. Furthermore (and perhaps more interesting), some other leak (from an internal Intel analysis in belatedly 2020) shows that either (1) the higher up rumor may be truthful, or (two) Intel may have severely underestimated AMD:

Intel is very confident about Diamond Rapids and believes information technology will exist their most competitive product in years. At this phase, Intel likely believes that neither AMD or ARM based server CPU providers can compete.

In any example, without further credible (and quantitative) information, the only estimate that one tin make is to detect that (in the most bullish scenario) Intel volition move from Intel iv (Granite Rapids) in 2023 to Intel 20A (Diamond Rapids) in 2024. This should allow Intel to double the core count, and leads to following further revised roadmap:

Source: Own Work

Equally such, the outlook in the data center for next few years is just what one wants to tell himself:

- AMD bulls will say that AMD was clever to introduce the Zen c-core. Even if Intel quadruples its core count from 56 in 2022 (Sapphire Rapids) to 224 in 2024 (Diamond Rapids), AMD will still be alee (256 cores).

- Intel bulls may neglect the c-core version of Zen 5 and compare a potentially 224-core Diamond Rapids to the 192-core Turin and discover that Intel is on rail to regain substantial competitiveness.

- Alternatively, the independently confirmed Sierra Wood rumors signal that Intel plans to introduce a high core count CPU in the data heart based on its E-cores. Given how small Intel's Due east-cores are, the heaven is the limit (eastward.g. 1024 cores in 2024-2025?). Although this may be exaggerating, those E-cores have already contributed to Intel regaining leadership in the PC with Alder Lake, and then it might be just a matter of Intel extending this strategy from the PC to the data center.

In that location is actually a lot of truth in the statement that the sky is the limit: given that both Intel and AMD take moved to chiplet-based designs, 1 could in principle only go along calculation chiplets indefinitely to farther increase the core count.

Upon review, I have to brand ane more comment though. I realized that information technology actually isn't sure yet that Intel will move to 20A in 2024 (in the data centre). If 20A misses the launch schedule for Diamond Rapids, and so I assume that Intel volition outsource this CPU to TSMC 3nm. In that case, both AMD and Intel might launch a 3nm CPU in 2024, farther demonstrating that both companies volition be quite closely matched. AMD bulls will run into this as a sign that nothing seems to preclude AMD from standing to gain market share.

Pat Gelsinger comments

Pat Gelsinger recently confirmed the thesis in this article. As he described it, the development cycles in the information center are longer, so he expects Intel and AMD to leapfrog each other with their sequent production launches ("nip and tuck"). And then overall, neither Intel nor AMD volition exist able to maintain a firm leadership position.

Water ice Lake wasn't our greatest product, but it closed some of the gaps. Sapphire Rapids closes all the gaps. So nosotros're now ahead with Sapphire Rapids coming in Q1 of next year. And on some of the benchmarks it'south close to AMD, on other benchmarks, it's unquestionably the all-time product. And like the AI performance of Sapphire Rapids is now 50% of the highest end Nvidia specialty processor, correct. It is dramatic, information technology'south hundreds of per centum amend than AMD'southward alternative at this point. And so we're clearly having some very stiff points of advantage with information technology.

AMD, we expect them to reply side by side year. Then it'south going to be a niggling flake nip and constrict over the next couple of years. And, as you suggests, information technology's going to be out a couple of years until nosotros're back to unquestioned leadership in the data center. It takes a fleck longer in the data middle side, the development cycles are longer. And every bit our procedure technologies get better and better, our server roadmap takes a footling bit longer to take advantage of that.

Although I would expect AMD bulls to question if even Sapphire Rapids will be competitive, for the AMD balderdash thesis, AMD actually doesn't need to take a huge advantage since AMD still has <15% market place share.

Source: Twitter

Long-term implications

In this section, I will discuss (at a high level) the implications in the information center in the long term. At least for Intel investors, this may be instructive given the new management and reorganizations in 2021.

1. AMD is reliant on TSMC

The commencement ascertainment is that in the data center, AMD'due south success is basically solely dependent on TSMC (and its competitiveness confronting Intel). The reason for this is because data eye CPUs can make use of an unlimited corporeality of transistors: this is primarily seen in the exponential increase in core count.

At first sight, this may seem lilliputian, and nothing for investors to worry about given TSMC'south execution in the last several years. Withal, equally I take discussed previously, this may be changing: TSMC Confirms 3nm Delay: What This Means For TSM Stock.

- TSMC for the start time in many years has explicitly used the word "filibuster" to describe one of its nodes. Furthermore, TSMC used "2025" and "2nm" in the aforementioned sentence, whereas a two-twelvemonth cadence would have indicated a (late) 2024 launch. Depending on when in 2025 exactly 2nm launches (early on or late in the yr), this could indicate a second sequent filibuster at TSMC.

- Intel, for the commencement time in many years, has explicitly used the words "on track or ahead of schedule" to describe all of its nodes until 2025. Intel claimed that it would regain process leadership with 18A in 2025.

Manifestly, such changes take many years. And so AMD bulls could detect that although Intel will likely better its competitiveness (at least if it succeeds in Gelsinger's plan), beingness roughly on par going forward (a few months ahead or backside) will not dramatically bear on AMD's competitiveness, particularly if by then AMD has already captured a significant amount of market share.

For example, a more material procedure technology advantage would exist on the guild of 1-ii years, merely that means if Intel only reaches parity in 2024, then TSMC must stall completely for Intel to regain a meaningful process reward even by 2026. Obviously, such far-out timelines are the reason for this commodity'due south more neutral stance towards Intel vs. AMD.

Nevertheless, ane more cautionary remark is required. Since AMD became a TSMC customer, the closest it has been to a leading edge customer was about three quarters afterward initial ramp (at 7nm), but this is increasing to two years at 5nm. So for case, if AMD would be 12-xviii months backside TSMC to prefer 2nm, then information technology would launch a 2nm CPU in 2026, compared to Intel which might launch a 20A CPU (Diamond Rapids) in 2024.

In other words, if Diamond Rapids is a 20A CPU (every bit discussed, information technology might besides exist a 3nm CPU though), then AMD could suddenly exist two years backside Intel, since it might non able to move to 2nm itself until 2026. This is exactly what I meant by AMD existence reliant on TSMC as a major risk. Hence, AMD non existence quick to adopt TSMC's latest tech could permit Intel regain a textile process advantage faster than expected.

2. Bullish case for Intel: flexing its financial muscles

If Intel is still so far from anything that vaguely resembles leadership, why would one be bullish about Intel? It ultimately comes down to three main arguments:

- Intel hasn't had a highly proficient technical CEO for ages. Bob Swan and Paul Otellini were both CFOs. The latter missed the mobile revolution, while the quondam was likewise focused on buybacks and operating margin despite the process engineering science bug still going on, which resulted in underinvestments in technology. In between, BK successfully transformed Intel's strategy beyond the PC, but internal politics and price cutting (perhaps due to force per unit area from the lath) likely harmed Intel, such as the major 2016-2017 reorg. In contrast, besides strong upper direction changes since Pat Gelsinger's re-entry, Intel is also gradually ramping upward the R&D spending afterward many years of stagnation (and conversely the buybacks have been paused). Intel'south main issue has simply been that its roadmap always kept getting delayed, not that its products have been poorly engineered. For instance, as Pat Gelsinger said, Intel has already added 6K engineers in only three quarters in 2021, which compares to AMD's 15K full employee count.

- As discussed above, Intel'southward improved applied science execution. For example, the chance that TSMC will have 2nm in 2024 is slim, which means Intel could have RibbonFET (gate-all-effectually) ahead of TSMC. In other words, Intel regaining procedure leadership is more realistic than investors may currently assume. In add-on, Intel is ownership upwardly large amounts of leading-edge chapters at TSMC.

- The main idea in these kind of discussions is that supposedly cadre count is the but thing that matters. This is a very flawed assumption. Given various differences in architecture and feature gear up, the bodily performance of AMD vs. Intel CPUs is highly variable and more nuanced than the superficial core count metric. This ways core count is non a reliable predictor of actual leadership. One common example is the important class of workloads of AI, where Intel can deliver many times higher functioning even with substantially lower cadre count: I have estimated Sapphire Rapids volition exist an astounding 240x faster than Milan-Ten. And earlier one would be tempted to dismiss such differences, one merely has to look at how NVIDIA (NVDA) has amassed a ~$800B marketplace cap (at its peak), which for a large part hinges on its performance in AI workloads in the information center.

The 12-month Granite Rapids delay has delayed Intel's power to regain unquestioned data center leadership by about 24 to 36 months. So overall, as I accept stated previously, I would currently view Intel as AMD in 2013 or so: it is known that Intel has competitive technologies in development, like was known near AMD in 2013, but information technology still took several years before these products even launched, never mind to be reflected in the stock cost.

Source: Twitter

Overall, the bullish scenario of Intel flexing its financial muscles to build more fabs and regain technology leadership remains valid (and as bonus, Intel will also buy a ton of TSMC capacity), only I currently don't see a lot of reasons (as well the low stock price) for investors to blitz to purchase the stock, since they may accept a few more years the opportunity to do and then.

Lastly, to come back on the 3rd signal above, I would refer to this recent assay every bit ane case.

something that a number of folks told me at the shows is that while the 3rd generation Intel Xeon "Ice Lake" may not have a core count advantage anymore, some of the accelerators are actually a big deal. The folks telling me this were either large hyper-scalers or vendors that sell to the hyper-scalers.

Risks

Although this article did a poor job in the post-obit regard, as mentioned above, investors should be aware that there is much more than to a (data eye) CPU than just its core count. A CPU contains literally dozens of additional features, going from security to virtualization, interconnect, acceleration, and more. Additionally, the architecture as well determines the performance that can be achieved per cadre.

Lisa Spelman, Intel VP: AVX-512 is such a great feature. Information technology has tremendous value for our customers that use it, and sometimes I marvel when I read your audience's comments most the raucous fence they will have about the value of AVX-512. But I tell y'all, and no joke, that a week and a half or and so before launch I was looking at a list of the bargain wins in ane of our geographies. 70% of those deal wins, the reason listed by our salesforce for that win was AVX-512. Optimization is real.

Secondly, Intel still has the advantage of being able to offer customers a much more comprehensive overall portfolio: CPUs, GPUs, NPUs, FPGAs, DPUs/SmartNICs/IPUs, Ethernet, Ethernet switches, Wi-Fi, silicon photonics and Optane.

Thirdly, as I have pointed out in other Intel coverage, Intel (and mayhap also AMD) is already valued on the stock market based on the expectation that Intel will fail to striking all of its roadmap targets. This removes a lot of farther INTC downside risk, only potentially could atomic number 82 to increased returns if Pat Gelsinger does start to deliver "unquestioned leadership".

Fourth, apparently both Intel and AMD could experience delays from their roadmaps. In detail, many AMD bulls seem to expect that Zen five will launch in 2023, for which there is no evidence whatsoever.

Summary

As I see information technology, both Intel and AMD will be competitive going forward in the medium term; it only depends on the use-example one looks at. Does 1 but demand a ton of cores for simple throughput tasks, then there is actually a company that already offers even more cores than AMD: Arm-based Ampere (led by a onetime Intel President). Does one need high SIMD throughput for HPC or AI, and then Intel AVX-512 and AMX remain unmatched. Does one need security features similar SGX or loftier crypto/pinch throughput, then Xeon will likewise offer much higher functioning than Epyc despite the lower core count.

Nevertheless, as an Intel shareholder, I would not consider it plenty for Intel to merely be "competitive" in some workloads given that for years the information center has been considered (including by Intel itself) to be Intel'southward highest growth market – and despite that, it is clear that Intel'southward execution in the information center has been its worst among all its segments.

So given the Zen 5 roadmap discussed, unless Intel comes up with some unexpected products (Sierra Forest?), then AMD shareholders will probable assume Intel could lose quite a chip more market share. Ultimately, Intel shareholders are banking on the Intel Accelerated roadmap (regain process leadership) too as Pat Gelsinger to make sure Intel solves its longstanding execution issues, only this volition likely accept several more years.

Investor Takeaway

In this commodity, I extended the data center discussion to 2024. This has shown that AMD retains a strong roadmap even several years from at present, as it plans to launch a 256-core CPU. Intel in likely the best-case would be at 224 cores (2x Granite Rapids, although not supported even past rumors nonetheless).

And then although my previous observation that Intel was moving faster (5.6x increase in cadre count) than AMD (4x increase in core count) seems to remain valid, this still may non exist plenty to have any chance of meaningfully surpassing AMD. This leads to a few takeaways:

- The lesser line is that Intel and AMD seem to be adequately closely matched (in core count) going forrard in the data center. I highlighted that both AMD and Intel have advantages depending on specific workloads.

- Information technology is not clear nevertheless how Pat Gelsinger intends to achieve "unquestioned leadership" in 2024-2025. It is on Intel to counter the AMD roadmap and testify proof of this in its fiscal results.

- Although not further discussed, I previously suggested the Intel Sierra Wood CPU line every bit Intel's solution, merely like how Intel has finally caught up with AMD on the desktop due to its hybrid architecture (P- and E-cores) with Alder Lake.

- Ultimately, the core count race in the data center will be adamant past Moore's Law, for which AMD is reliant on TSMC and Intel on its ain fabs. This was already clear in the last few years, when Intel was stuck with just 28 cores at 14nm, and more than recently had to filibuster Granite Rapids due to the 7nm delay. Indeed, Intel has only promised to achieve parity in 2024 (and leadership in 2025). This suggests Intel's earliest chance to achieve a meaningful gap over AMD might be in the second one-half of the decade. I presume AMD investors will consider this to be a sufficient time gap.

So given the current trends in process engineering, in the mid term ultimately information technology will probable be other factors (such as pricing, sales and marketing, differentiated features) than just the cadre count that will determine who will take highest market place share going frontwards and the relative market place share movements. Intel should be ameliorate positioned in that regard, only the Zen 5 rumors are more bullish than AMD'south execution has been on Zen 4, although nether the caveat that Zen 5's precise launch window remains unknown. Conversely, AMD bulls should not condone Intel's "new" roadmap under Pat Gelsinger too early either.

This article was written past

With an engineering background, looking for companies with expertise to be well-positioned for growth and leadership.

Disclosure: I/nosotros accept a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving bounty for it (other than from Seeking Alpha). I have no business concern relationship with whatsoever visitor whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4476675-amd-vs-intel-intc-i-was-wrong-about-amd

Belum ada Komentar untuk "Intil Will Overtake Amd Again Intel Will Overtake Amd Again"

Posting Komentar